JPMorgan Asset Management is increasing its investment in Indian government bonds, considering them the top choice in Asia, Bloomberg reported on Monday. This decision precedes India’s addition to a major emerging market debt index.

JPMorgan sees Indian bonds offering the best combination of high yields and low volatility within Asia’s sovereign debt landscape. This strategy follows a recent reduction in Chinese government bond holdings by the firm.

The firm raised its bond holdings in April as the yield on the 10-year benchmark bond surpassed 7.15 per cent, stated Julio Callegari, Asia fixed income’s chief investment officer. It also sold some Chinese government notes during that time.

Callegari expressed a preference for Indian local currency bonds due to their high yields and stability, noting that there are limited options for carry in the sovereign space onshore in Asia.

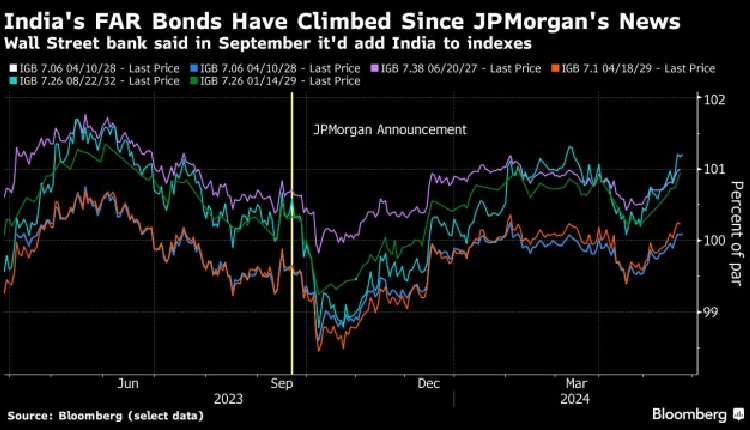

Indian sovereign bonds have attracted $8 billion in inflows through the Fully Accessible Route (FAR) since JPMorgan’s announcement, despite some outflows in April due to a global debt selloff.

Analysts estimate that the bond index’s inclusion could bring in up to $40 billion in inflows. On Monday, ten-year yields were around 7.04 per cent.

India’s higher returns and stable currency make it an attractive investment compared to other higher-yielding Asian countries like Indonesia, which may lack stability.

Bloomberg Index Services Ltd. will add India to its emerging-markets index in January, further boosting the country’s investment appeal.