European natural gas prices rebounded after a two-day decline as the possibility of extended disruptions to the vital shipping route of the Red Sea increased due to more attacks on ships.

On Wednesday, benchmark futures saw a 3.1 per cent increase.

The U.S. and the U.K. retaliated after Houthi launched one of their biggest missile and drone attacks to date on commercial shipping lanes in the Red Sea.

Although fuel supplies haven’t been directly impacted by Red Sea tensions thus far, European gas markets usually respond to alarming signals.

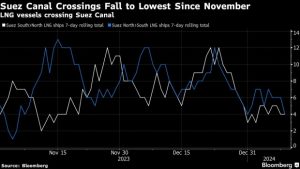

The majority of shippers have chosen to take longer trips around Africa, but Qatari liquefied natural gas carriers have continued to travel via the Suez Canal, which is the quickest route to Europe.

Additionally, forecaster Maxar Technologies Inc. predicts that below-average temperatures will persist in Europe for at least another week, which could increase demand for heating.

The European benchmark for gas, Dutch front-month futures, saw a 2.2 per cent increase to €31.33 per megawatt-hour at 8:59 a.m. in Amsterdam.