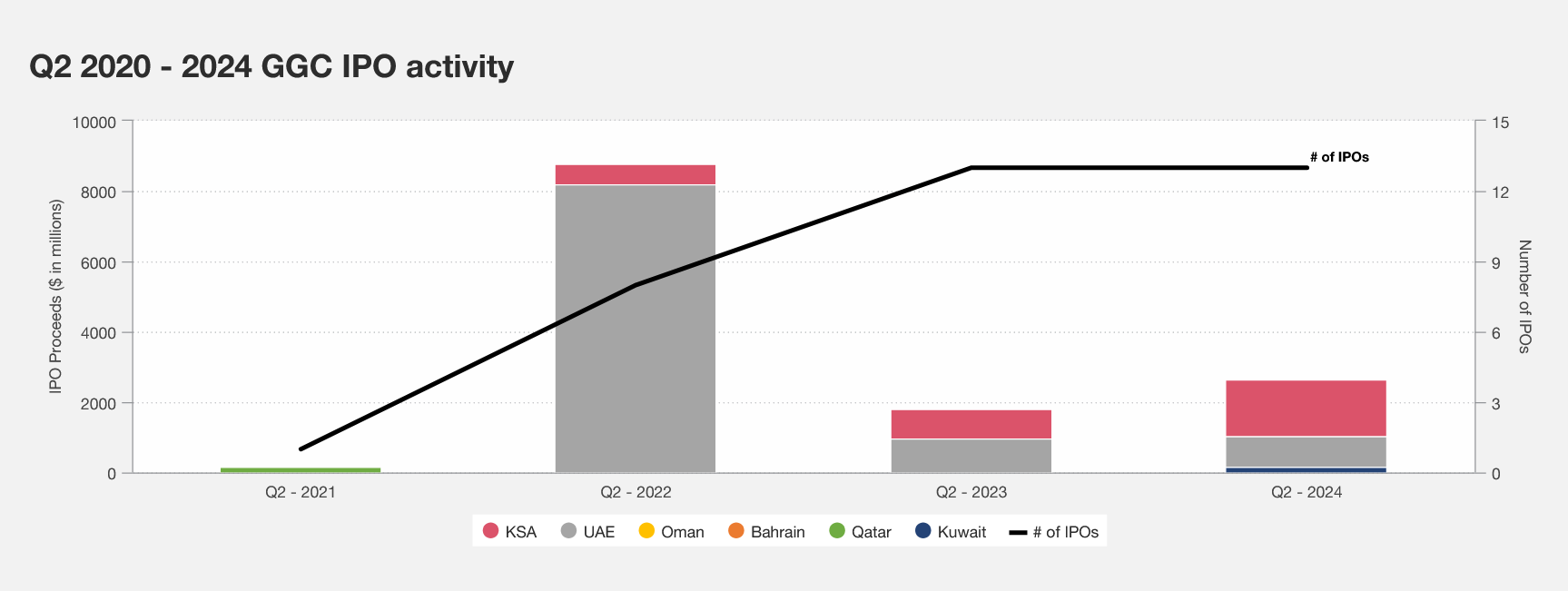

The GCC initial public offering (IPO) market experienced a strong second quarter, with 13 deals raising a combined $2.6 billion, surpassing the $1.8 billion raised in the same period last year, according to PwC Middle East’s latest IPO+ Watch.

“We have witnessed some volatility in the first half of 2024 in the performance of GCC stock exchange indices and oil prices. That said, the number of new IPOs in the GCC continued to remain strong. Saudi Arabia continued to dominate the IPO market, with H1 2024 experiencing 19 IPOs compared to 17 IPOs in H1 2023.” the report read.

Saudi Arabia dominated the region, accounting for 61 per cent of the total with $1.6 billion in IPO proceeds. Notable Saudi IPOs included Dr. Soliman Abdel Kader Fakeeh Hospital Company, which raised $763 million on the Tadawul Stock Exchange.

The UAE also witnessed significant activity with large listings from Alef Education and Spinneys. Leading the charge were Alef Education, which raised $515 million on the Abu Dhabi Securities Exchange (ADX), and Spinneys, which secured $375 million on the Dubai Financial Market (DFM).

This quarter was also the first time Boursa Kuwait witnessed its first IPO since 2020, with the Beyout Investment Group Holding Company raising $147 million.

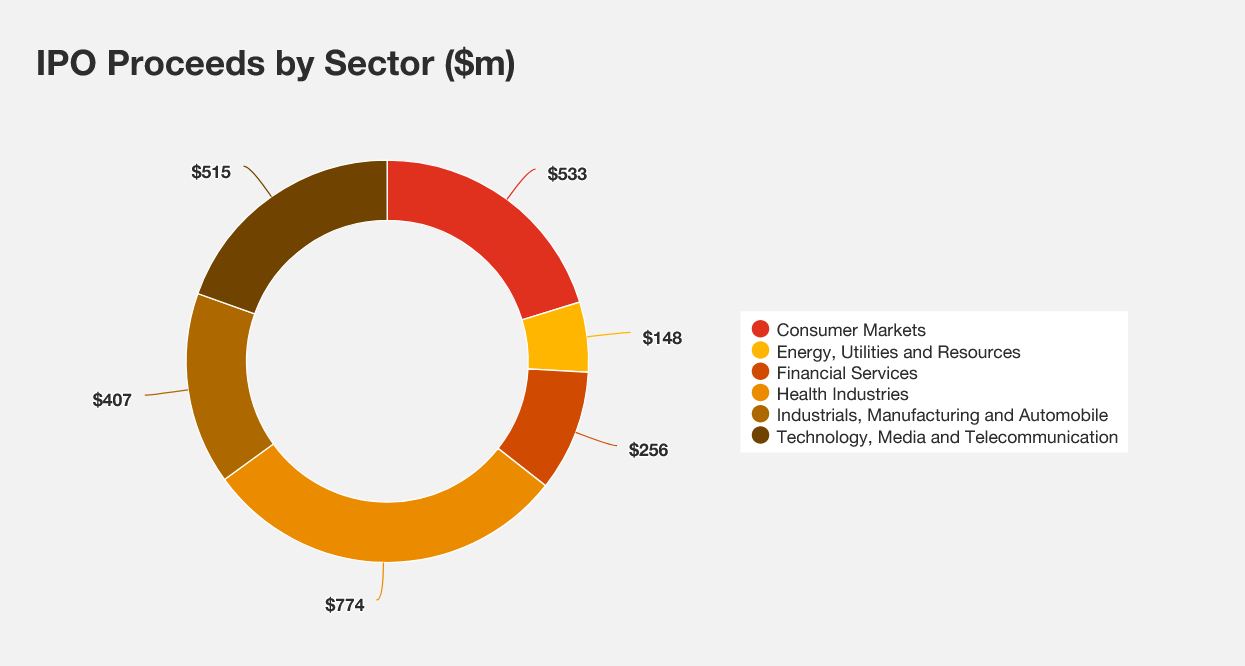

The report also shows that IPO activity was experienced across a diverse range of sectors during the second quarter, including health industries ($774 million), consumer markets ($530 million), financial services ($256 million), energy, utilities and resources ($148 million), industrials, manufacturing, and automobile ($407 million), and technology, media and telecommunication ($515 million).

Moreover, the PwC report also referred to a significant rise in sukuk issuances, totaling over $10 billion this quarter, compared to $2.6 billion last year, highlighting strong demand for shariah-compliant financial products.

“Looking forward, the outlook for the GCC IPO market continues to remain positive with strong issuance expected for the remainder of 2024, subject to the wider geopolitical environment and oil prices.” the report concluded.

Attribution: PwC Middle East’s latest IPO+ Watch

Subediting: Y.Yasser