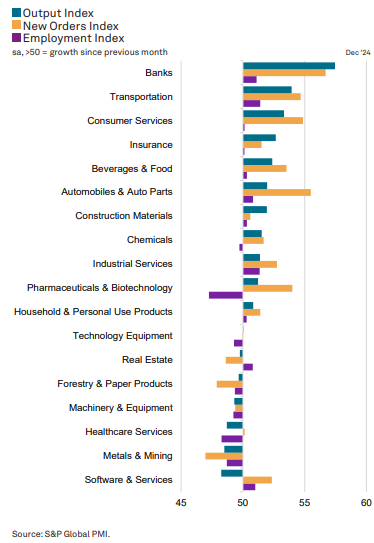

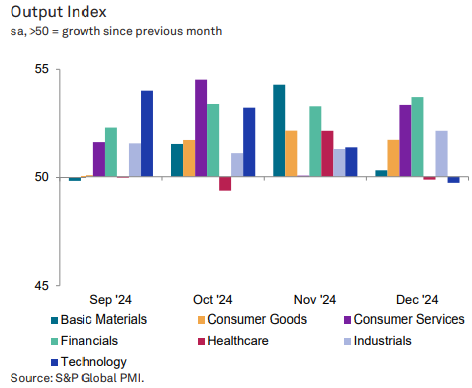

Asia’s economic activity slowed in December 2024, with growth recorded in only 11 out of the 18 sectors monitored by S&P Global’s Asia Sector PMI data, down from 15 in the previous month. Despite this, two-thirds of these sectors experienced historically strong growth rates.

Banking Sector Leads the Upturn

The banking sector emerged as the standout performer, driving the region’s economic upturn. Growth in the sector accelerated sharply, reaching its fastest pace since March 2023, significantly outpacing other sectors. This surge was enough to offset slower growth in insurance and a slight decline in real estate activity, propelling the broader financials sector to the top of the performance rankings for the year.

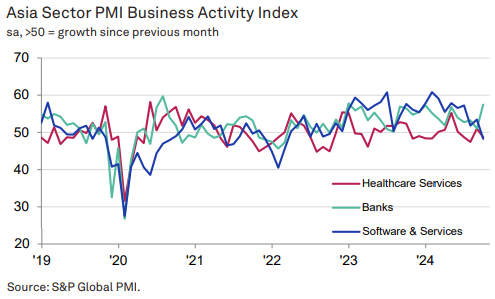

Software & Services Sector Experiences Decline

In contrast, the Software & Services sector saw a decline in activity for the first time in two years. This drop, the steepest since May 2022, marked a dramatic shift from the sector’s previously strong performance, which had consistently led the region since 2023.

Stable Demand and Job Creation Across Sectors

Despite the reduction in output across several sectors, demand remained stable. Thirteen sectors out of eighteen saw an increase in new orders, and this stability contributed to job creation in 11 sectors, the highest number recorded in the final quarter of 2024.

Price Pressures Persist, but Inflation Moderates

Price pressures were widespread, with all sectors except Metals & Mining facing higher cost burdens. However, businesses were cautious in passing on these costs, with only 13 sectors raising prices, and inflation rates generally moderated.

In conclusion, while overall growth in Asia slowed in December, the banking sector’s strong performance helped the financials sector top the rankings for 2024, highlighting its resilience in a challenging economic environment.

Attribution: Amwal Al Ghad English

Subediting: M. S. Salama