Swiss c.bank pioneers first live DLT-based monetary operation

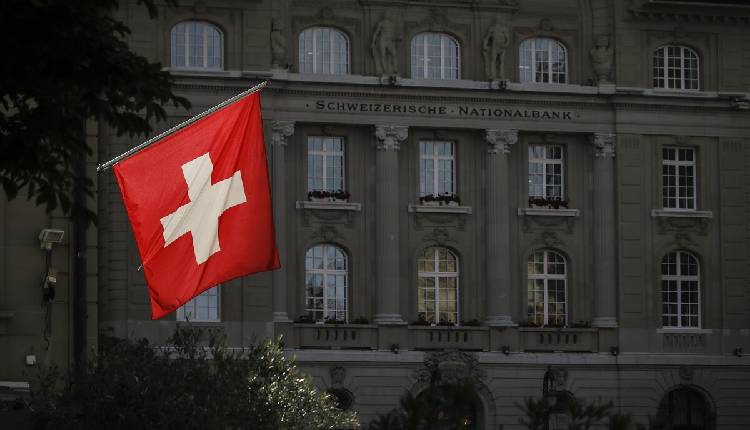

The Swiss National Bank (SNB) has become the world’s first central bank to perform a monetary policy operation using distributed-ledger technology (DLT) in a live production environment.

The announcement was made during a press conference in Zurich on June 20, which initially covered updates on inflation and the Swiss economic outlook before highlighting fintech innovations, specifically the advancements in its wholesale central bank digital currency (CBDC) pilot, known as Project Helvetia.

Earlier this month, the SNB has successfully issued digital SNB bills on the SIX Digital Exchange (SDX), the tokenised assets platform of the SIX Swiss Exchange. The issuance had a volume of CHF 64 million (approximately £56.6 million or $71.6 million) with a term of one week.

Project Helvetia, currently in its third phase since December 2023, is set to continue for at least two more years, with plans to expand its scope.

The SNB emphasised its leadership in deploying wholesale CBDC in a live production setting and expressed the hope that more financial institutions will participate, ultimately extending the use of wholesale CBDC to a broader range of financial transactions.

Attribution: Global Government Fintech