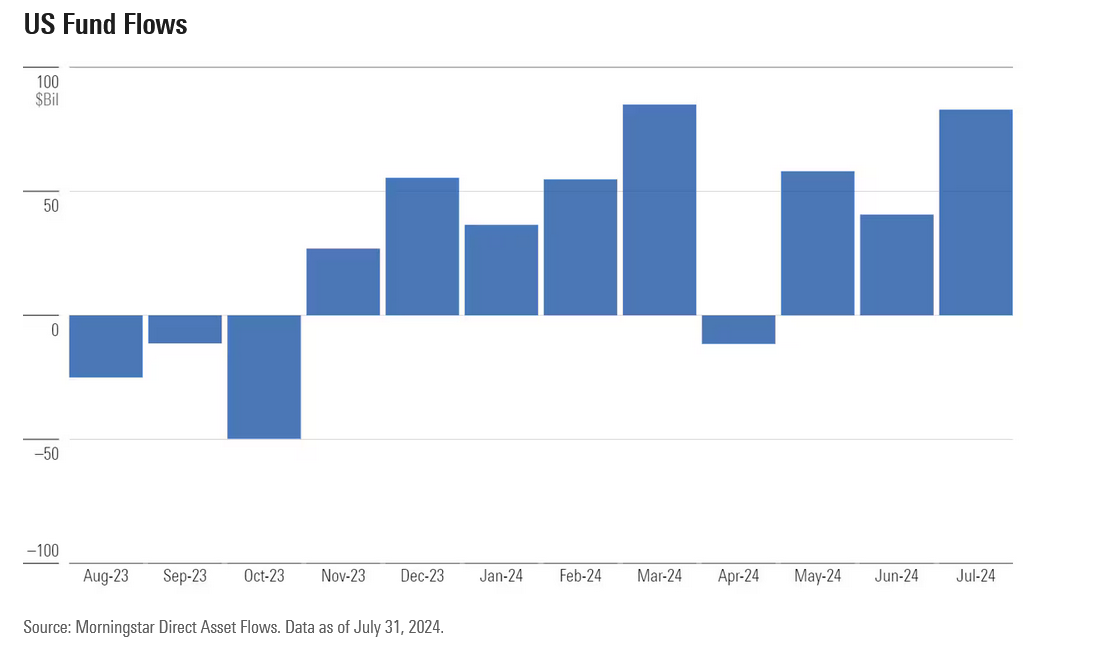

US funds experienced strong inflows in July, totaling $83 billion, according to data was sourced from Morningstar Direct. This marks the second-best month for fund flows so far this year. Equity funds generally saw moderate inflows, while fixed-income funds attracted larger sums.

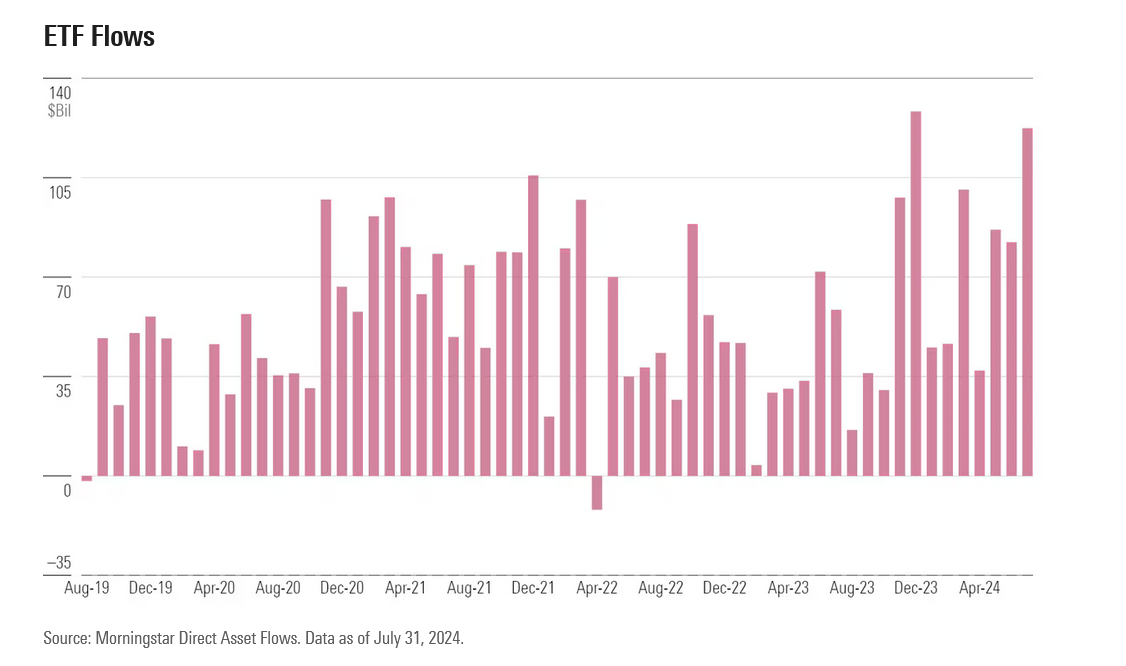

ETFs Continue to Dominate

Exchange-traded funds (ETFs) continued their impressive performance, attracting $122 billion in July. This was the second-highest monthly inflow on record, falling just short of the $128 billion record set in December 2023. In contrast, mutual funds experienced outflows of $39 billion.

US Fund Flows Heat Up

Taxable-Bond Funds Rebound

Taxable-bond funds have made a significant comeback, nearing their all-time high of $5.57 trillion reached in December 2021. This follows a period of outflows and underperformance.

Municipal-Bond Funds Gain Momentum

Municipal-bond funds have also seen a resurgence, attracting nearly $7 billion in July. This is the highest monthly inflow since August 2021, putting them on track for a positive year after several years of outflows.

Small-Cap ETFs Shine

US equity funds gathered $20 billion in July, extending their positive streak for the year. While S&P 500-tracking funds typically dominate this category, the iShares Russell 2000 ETF (IWM) stood out, attracting $6.9 billion in July.

Vanguard’s VOO Continues to Break Records

Vanguard has been a major player in the fund flow market, accumulating $118 billion in 2024. The Vanguard S&P 500 ETF (VOO) alone has attracted an astonishing $54 billion, already surpassing the annual inflow record for any fund.

Attribution: Morningstar