Endeavour Mining abandons bid to buy Centamin on insufficient information

Endeavour Mining abandoned its 1.47 billion pound ($1.9 billion) pursuit of Centamin, saying it receive insufficient information on the Egypt-based miner’s assets during an assessment.

“The quality of information received during the accelerated due diligence process has been insufficient to allow us to be confident that proceeding with a firm offer would have been in the best interests of Endeavour shareholders,” Endeavour CEO Sebastien de Montessus said in a statement.

Centamin rebuffed the all-stock takeover proposal from Endeavour in December, saying it did not offer enough value to Centamin shareholders.

Since then, the U.K’s takeover panel agreed to extend a deadline for Endeavour to make a firm offer, to allow more time for the two sides to engage and share information.

Centamin’s London-listed shares fell more than 4% after the announcement but are up about 10% since Endeavour’s takeover proposal on Dec. 3. Endeavour’s shares are down by about 12% in Toronto.

Endeavour’s de Montessus said the company was still convinced about the strategic rationale of combining the two miners to create a diversified gold producer with a high-quality portfolio of assets.

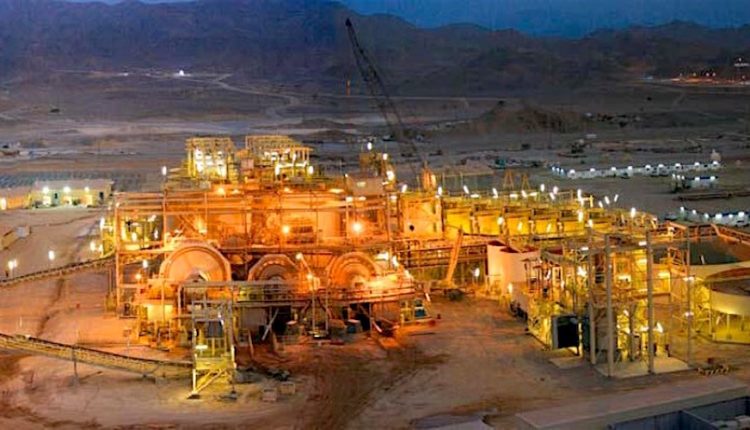

Centamin said last week its fourth-quarter production rose by 51% to 148,387 ounces, bringing its 2019 output to 480,529 ounces. This fell short of its annual target range but was a 2% increase year-on-year.

Centamin has struggled shifting from open pit to underground at the Sukari mine and is still on the hunt for a chief executive after hiring a new non-executive chairman in December.