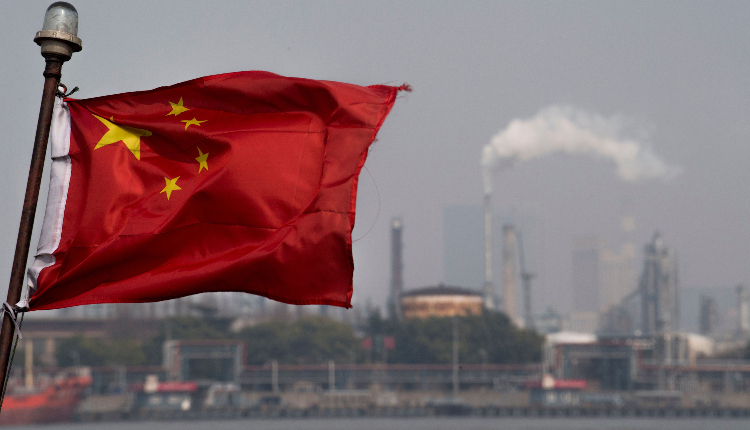

China’s bond market, the world’s second largest, is facing uncertainty as the central bank intervenes to stabilise yields amid economic challenges.

Despite government efforts to cool the market, some investors remain optimistic due to China’s economic instability, deflationary pressures, and low risk appetite. A bond fund manager expressed continued bullishness despite recent market fluctuations.

“We don’t see a rosy economic picture … and we’re under peer pressure to generate returns,” said a Beijing-based manager, who asked to be anonymous due to sensitivity of the topic.

China’s central bank, the People’s Bank of China (PBC) has issued warnings about bubble risks as investors flock to government bonds and shy away from volatile stocks and a declining property market.

Banks are also reducing deposit rates, adding to the challenges faced by PBC in stabilising the weakening yuan.

The PBC is taking steps to address the bond market frenzy, marking a new front in its ongoing efforts to combat speculation and unwanted price fluctuations in the stock and currency markets.

China’s financial markets, including the bond market, are regulated from the top-down, explained Ryan Yonk, an economist at the American Institute for Economic Research.

As the economy struggles, Chinese officials may find it challenging to sustain such strict control over financial markets, leading to potential interventions that could indicate the instability they are trying to prevent.

Attribution: Reuters