During Tuesday closing session, the Egyptian Exchange (EGX) has posted gains of EGP 5.91 billion as the capital market has amounted to EGP 411.555 billion.

EGX indices closed in green.

The main index, EGX30 soared by 2.15% to close at 5956.44 p. EGX20 jumped by 1.91% to end at 7015.19 p.

Meanwhile, the mid- and small-cap index, the EGX70 hiked by 1.79% to conclude at 568.54 pts. Price index EGX100 inched higher by 1.85% to finish at 935.76 p.

Traded volume reached 231.629 million securities worth EGP 989.814 million, exchanged through 45.650 thousand transactions.

This was after trading in 184 listed securities; 28 declined 149 advanced while 7 keeping their previous levels.

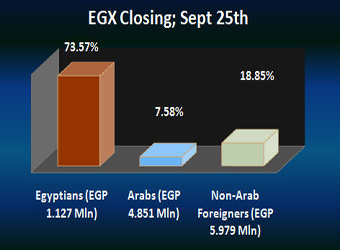

Egyptians and Arabs were net sellers seizing 73.57% and 7.58% respectively, of the total markets, with a net equity of EGP 1.127 million and EGP 4.851 million excluding the deals.

On the other hand, non-Arab Foreigners were net buyers seizing 18.85% of the total markets, with a net equity of EGP 5.979 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance.

Citadel Capital:

Citadel Capital (CCAP.CA) jumped by 5.26% to end at EGP 4.60.

Talaat Moustafa Group:

Talaat Moustafa Group (TMGH.CA) surged by 3.65% to hit EGP 5.68.

Commercial International Bank:

Commercial International Bank- Egypt (CIB) (COMI.CA) climbed by 3.45% to end at EGP 35.69.

Orascom Construction Industries:

Orascom Construction Industries (OCIC.CA) surged by 1.89% to finish at EGP 293.12.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) soared by 1.82% to end at EGP 12.31.

In a press release, EFG Hermes announced that the Group is launching its brokerage ATMs Monday across its branches in Egypt.

The machines — the first securities brokerage ATMs on the Egyptian market — will allow customers to make multiple transactions without being restricted to branch operating hours and without the need for a human cashier, clerk or teller.

This first service of its kind in Egypt is an integral component of our overall vision to expand our retail brokerage arm and introduce a superior customer service model that gives our clients the best possible transaction experience.

Customers will be issued a unique EFG Hermes Securities Brokerage ATM card, which will allow them to access any of the ATM machines located in eight strategic branches in Cairo, Alexandria and Mansoura. Cairo branches include Dokki, Mohandeseen, Maadi, Nasr City, Smart Village and Haram.

Key features of the service include the ability to deposit and withdraw funds from trading accounts. All deposits, whether cash or proceeds from trading are credited to the clients’ account on-the-spot allowing them further flexibility to execute timely trades with minimum hassle, clients can also check their account balance, either on-screen or in the form of a mini-statement.

“As the leading broker in the region, we aim to be at the forefront of innovation in our industry,” said Mohamed Ebeid, Co-Head of EFG Hermes Securities Brokerage. “This new fleet of ATMs offers EFG Hermes clients a unique customer experience, giving us a clear competitive advantage over other local brokers.”

This impressive new service is just the latest in a long list of innovative developments from our Securities Brokerage team who have brought to market an unparalleled range of products and services for both individual and institutional clients such as online trading, mobile trading, margin trading and multi-market access backed up by the region’s leading research house. This complementary bouquet services provides clients with fast, secure, multi-platform trading tools that allow them to buy and sell a wide range of securities

As a result of these endeavors, the team has also garnered numerous awards this year, most recently crowned as Best Brokerage House in Egypt at the Global Banking and Finance Awards 2012. This was only a few months after the team also won Best Broker in Kuwait at EMEA Finance’s Middle East Banking Awards.

“As always, we are not contenting ourselves with what we have already accomplished,” added Ahmed Waly, Co-Head of EFG Hermes Securities Brokerage. “Already the team is working on developing new features for the ATMs and expanding the ATM network to cover more areas in Egypt.”

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) hiked by 1.82% to end at EGP 0.56.

GB Auto:

Ghabbour Auto – GB Auto (AUTO.CA)’s stock rose by 1.60% to close at EGP 27.94.

EFSA) has sent Tuesday a release to the EGX stating that it approved GB Auto’s step to call for an extraordinary General meeting to discuss the reduction of the company’s paid-up and issued capital through cancelling the treasury stocks purchased more than a year ago. A year earlier, GB Auto had purchased treasury stocks amounted to 107100 thousand in which the par value is one Egyptian Pound per share.

The company’s coming EGM will be also discussing the amendment of the Articles 6 and 7 of GB Auto’s basic system in the sidelines of capital reduction. It will also discuss submitting a disclosure form as per Article No. 16 of the Listing and Delisting Regulations.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) inched higher by 1.59% to close at EGP 3.84.

Telecom Egypt Co.:

Telecom Egypt (ETEL.CA)’s stock dived 2.31% to end at EGP 14.39.

This was after Telecom Egypt – TE (ETEL.CA) had sent Tuesday a release to the Egyptian Exchange (EGX) announcing that the TE Chairman Akil Beshir resigned from his post and retired as of 01/10/2012. Beshir has served in TE for 12 years.

TE noted that the firm will be announcing a new Chairman of the board before the end of September.

“Throughout my term as the TE chairman, the company has witnessed significant changes in the local telecommunication market.” Eng. Akil Bashir said.

Beshir had been appointed Chairman and CEO of the Telecom Egypt in June 2000. He passed on his executive duties as CEO in August 2009, becoming non-Executive Chairman.