Kuwaiti banks are benefiting from an increase in mergers and acquisitions (M&A), a development that Fitch Ratings considers credit-positive for the sector. The overbanked market has prompted banks to pursue M&A as a strategy to diversify their business models and enhance their financial profiles amid limited organic growth opportunities.

However, despite Kuwait’s strong fiscal and external balance sheets, the banking sector’s growth encounters obstacles due to political gridlock and institutional challenges. These include delays in implementing key reforms, such as the Public Debt Law and the mortgage law.

Fitch does not expect the merger between Boubyan Bank and Gulf Bank, Kuwait’s second- and fifth-largest Islamic banks respectively, to be finalised before 2025. Once completed, this merger would create an Islamic bank with approximately KWD16 billion ($53 billion) in assets and a 15 per cent market share.

In June, Burgan Bank announced its plans to acquire a 100 per cent stake in Bahrain’s United Gulf Bank. This move follows recent sales of stakes in Burgan Bank Turkiye and Bank of Baghdad. It forms part of Burgan’s strategy to focus on the GCC region and is associated with the Kuwait Projects Company (KIPCO) group.

The planned merger between Gulf Bank and Al Ahli Bank of Kuwait, which would have involved converting one bank to Islamic, was canceled in 2023.

In 2022, Kuwait Finance House (KFH) expanded its footprint by acquiring Bahrain-based Ahli United Bank, extending its presence to Bahrain, Egypt, and the UK, with further expansion plans for Saudi Arabia. Nonetheless, KFH recently sold KFH-Bahrain and is divesting from Malaysia.

Boubyan Bank had previously acquired a majority stake in the Bank of London and the Middle East in 2020 to diversify its operations.

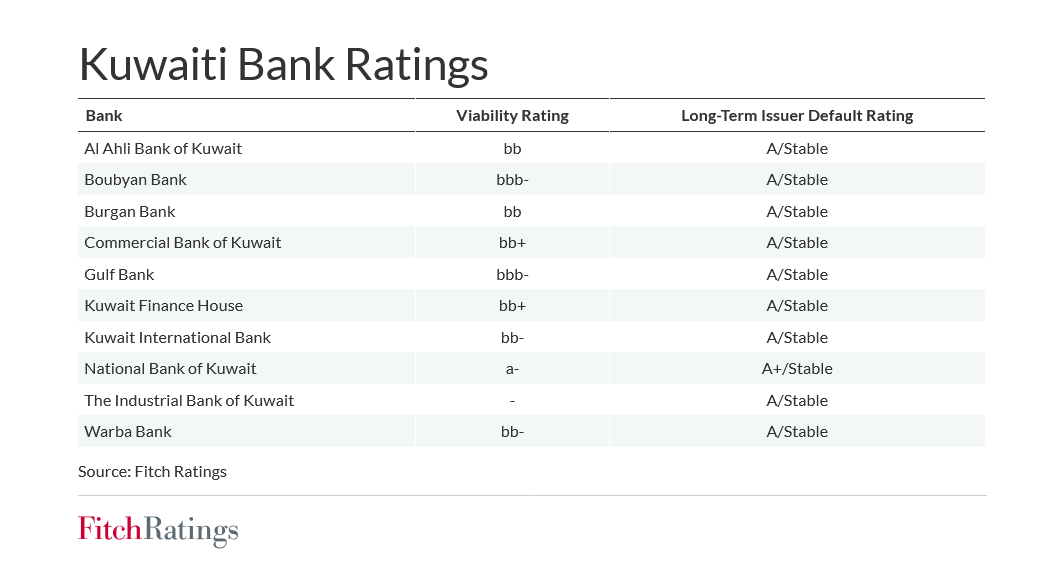

There are ten banks in the Kuwaiti banking sector, all rated by Fitch, which projects modest credit growth of 3-4 per cent for the sector in 2024, compared to 2.3 per cent in 2023 and 3.7 per cent in the first half of 2024. This is due to high interest rates (the reference rate for lending is 4.25 per cent), modest real GDP growth (projected at -2.1 per cent in 2024 and 2.9 per cent in 2025), and political divisions. Despite these challenges, Kuwaiti banks maintain adequate capital and robust risk-management practices, which could support faster credit growth if political and institutional issues are addressed.

Attribution: Fitch Ratings

Subediting: Y.Yasser