Fitch sees Egypt’s central bank to raise rates at March 24 meeting

Egypt’s central bank will raise key interest rates in its upcoming 24 March monetary policy meeting, said Ratings agency Fitch in a recent report.

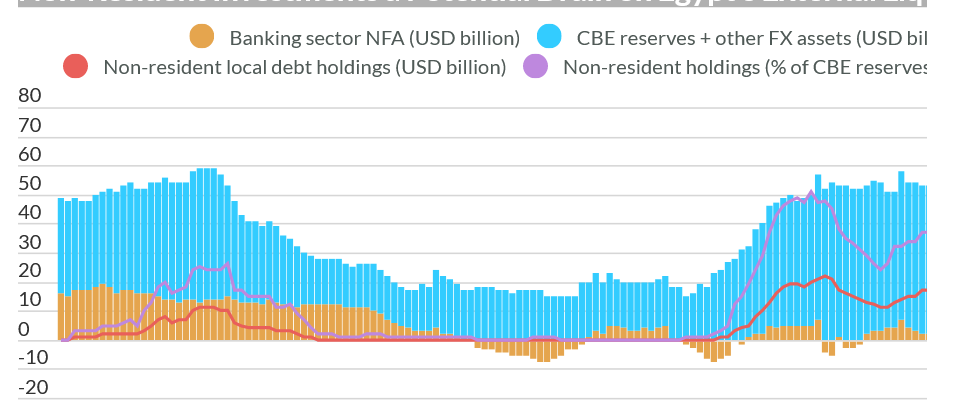

Fitch sees higher interest rates as being among the policy options available to the authorities in Egypt to shore up the country’s external position.

“Food price inflation and higher interest rates could complicate efforts to reduce the general government deficit from USD29 billion (7.2% of GDP) in FY20/21. The FY21/22 budget included USD5.5 billion for food subsidies. General government interest payments on local debt amounted to 30% of expenditure and 8% of GDP in FY20/21.” Fitch report read.

“When affirming Egypt’s ratings at ‘B+’ with a Stable Outlook in October 2021, we identified renewed external financing strains as one of the drivers that could lead to negative rating action.”

Nonetheless, Fitch said a number of factors have supported Egypt’s resilience, including “strong relationships with bilateral and multilateral lenders and a positive record of fiscal and economic reform.”

“We now believe another funded IMF programme is likely and expect the CBE to raise the policy interest rate in its 24 March meeting.”

“Egypt’s GCC partners could also extend support using the additional fiscal space provided by high oil prices. However, it is unclear whether the EGP/USD exchange rate will depreciate, given its rigidity in recent years and potential concerns about the impact of depreciation on inflation and domestic and foreign investor confidence.”

The Central Bank of Egypt (CBE) maintains that it is committed to exchange-rate flexibility, Fitch said.