Wall Street bankers and traders, given hope by a market rebound in the first quarter, are now seeing earnings and paychecks threatened by turmoil in Greece in what is becoming an annual cycle.

For a third consecutive year, revenue from investment banking and trading at U.S. firms may fall at least 30 percent from the first quarter, Richard Ramsden, a Goldman Sachs Group Inc. (GS) analyst, said in a note last week. Greece, which gave English the word “cycle,” has been the main reason each year that the second quarter soured after a promising first three months.

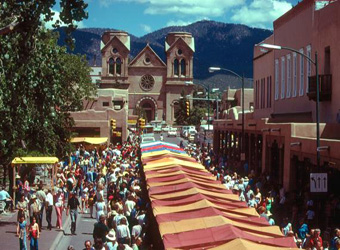

Deal volume has dropped and equity and credit markets have fallen on concern that Greece may abandon the euro and the European sovereign-debt crisis will spread to nations including Spain. Photographer: Scott Eells/Bloomberg

June 5 (Bloomberg) — David Trone, an analyst at JMP Securities LLC, talks about the European debt crisis and its impact on U.S. banks. Trone, speaking with Tom Keene on Bloomberg Television’s “Surveillance Midday,” also discusses the outlook for the labor market, financial industry regulation and executive compensation. Bloomberg’s Laura Marcinek also speaks. (Source: Bloomberg)

Deal volume has dropped and equity and credit markets have fallen on concern that Greece may abandon the euro and the European sovereign-debt crisis will spread to nations including Spain. Those economic issues cut profit, bonuses and jobs at Wall Street firms in last year’s second half and threaten to do the same in 2012.

“It’s going to be a tough summer at least, and it does feel like the last couple years all over again,” said David Konrad, an analyst at KBW Inc. in New York. “The bank valuations seem unfairly discounted, but investors are looking at this year and saying, ‘I’m not going to fall for this again.’”

Greece is compounding the impact of stiffer capital rules and trading restrictions for banks imposed after 2008’s credit crisis. Those measures already were fueling concern that the industry may be locked in a long-term slump. Combined trading and investment-banking revenue at the five biggest Wall Street banks — JPMorgan Chase & Co. (JPM), Goldman Sachs, Bank of America Corp. (BAC), Citigroup Inc. (C) and Morgan Stanley — is likely to drop from a year earlier for the seventh time in eight quarters, according to analysts surveyed by Bloomberg.

The five banks generated about $33 billion from those businesses in the first three months of the year, excluding accounting charges. That was led by $20 billion from fixed- income trading.

Revenue from trading typically peaks in the first quarter in part because corporations raise more debt at the beginning of the year, stoking fixed-income operations, said Roger Freeman, an analyst at Barclays Plc.

Still, a normal seasonal decline for fixed-income trading revenue in the second quarter is 15 percent, while this year probably will be 30 percent to 40 percent, Goldman Sachs’s Ramsden said. Last year, the second-quarter drop for U.S. firms was about 31 percent, while in 2010 it was more than 40 percent.