Natural gas price declines led to a significant reduction in revenue for US oil producers during the first quarter of 2024, according to data from Evaluate Energy.

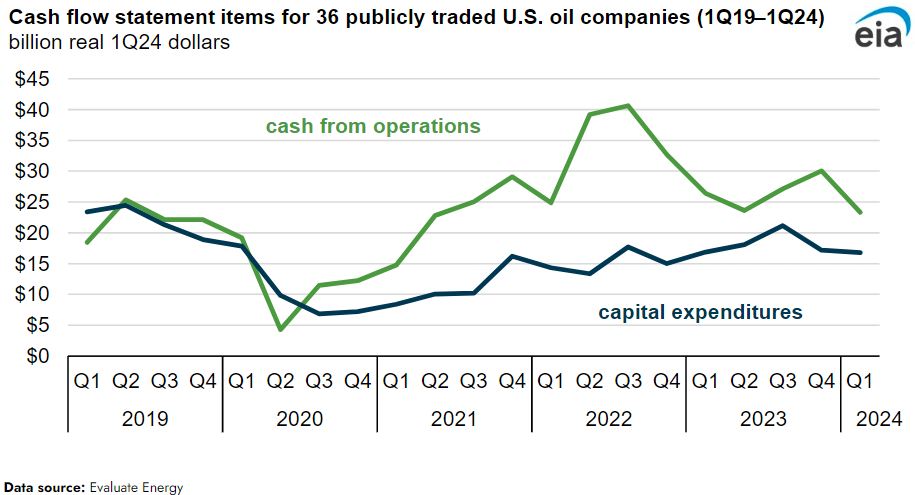

Financial results from 36 publicly traded US oil exploration and production (E&P) companies showed a 12 per cent drop in cash from operations compared to the same period in 2023, totaling $23.3 billion. This occurred despite a 5 per cent increase in crude oil production, which reached nearly 4.2 million barrels per day (bpd).

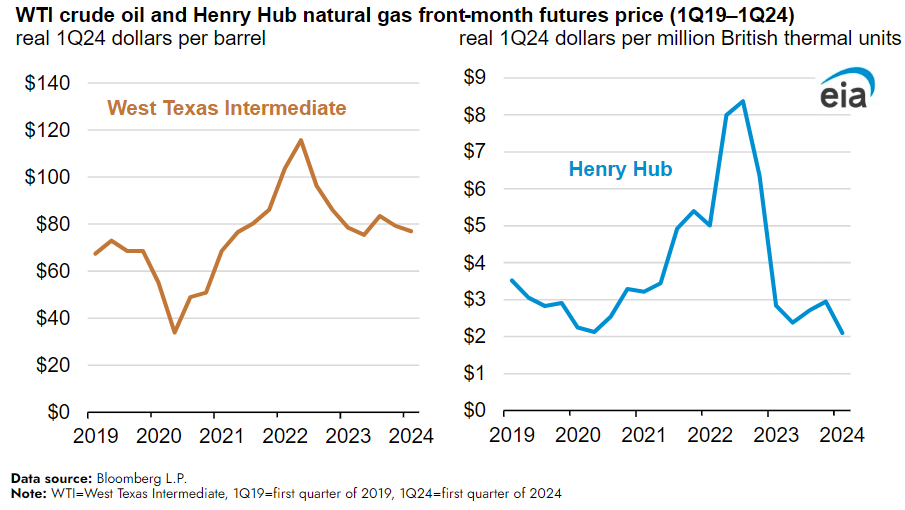

West Texas Intermediate (WTI) crude oil prices decreased by 2 per cent, while natural gas prices saw a substantial decline of 26 per cent, hitting their lowest inflation-adjusted level since 1997. Although these companies primarily focus on crude oil production, natural gas typically constitutes about 30 per cent of their output, contributing to the overall decrease in revenue.

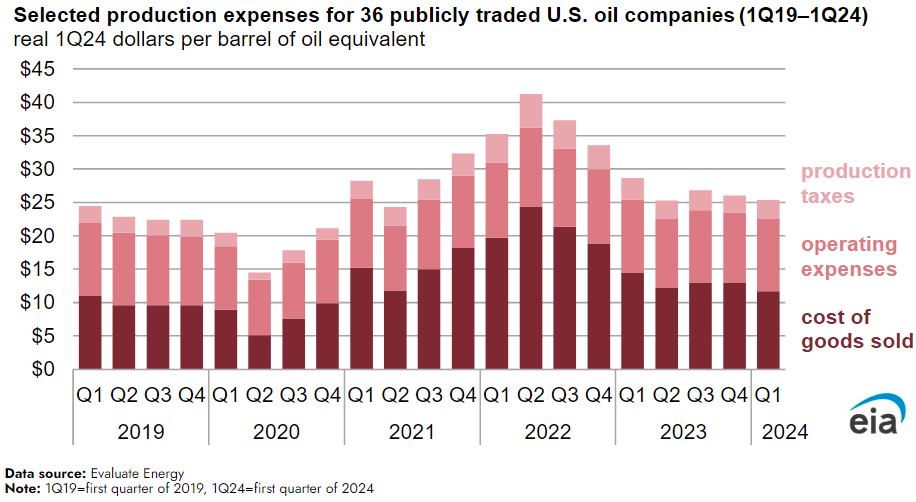

Production expenses, which had surged during 2021 and 2022 due to supply chain disruptions, have since stabilised. These costs fell by 40 per cent between the second quarter of 2023 and their peak in the second quarter of 2022, averaging $26 per barrel of oil equivalent (BOE). Increased drilling efficiency and expanded capacity in the Permian region further supported the reduction in production costs.

This analysis covers companies responsible for 32 per cent of US crude oil production, amounting to approximately 4.2 million bpd during the period.

Attribution: Energy Information Administration (EIA)

Subediting: M. S. Salama