Egypt’s non-oil private sector maintained growth momentum in February, as client demand continued to strengthen, marking a second consecutive month of expansion, according to S&P Global’s Purchasing Managers’ Index (PMI) data published on Tuesday. However, employment levels fell, and output remained stable despite a solid increase in purchasing activity.

PMI Remains in Growth Territory Despite Slight Decline

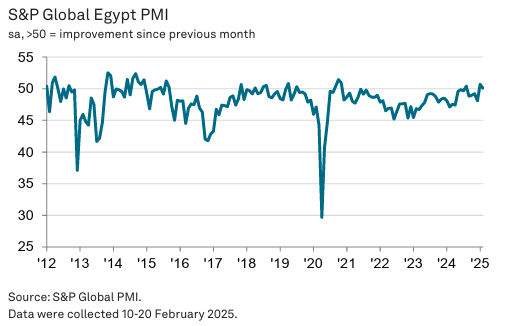

The seasonally adjusted S&P Global Egypt PMI registered 50.1 in February, slightly down from January’s 50.7, which had been a 50-month high. Despite the marginal drop, the index remained above the neutral 50.0 threshold, signalling an ongoing improvement in operating conditions. This marked the first back-to-back expansion in over four years.

New Orders Rise, But Manufacturing Faces Challenges

New order volumes continued to rise, extending January’s upturn and reinforcing a sustained recovery in market conditions. However, the expansion slowed from the previous month, partly due to a decline in manufacturing orders.

Purchasing Activity Gains Momentum

The rise in demand prompted businesses to increase purchases at the sharpest rate in three-and-a-half years. However, firms struggled to retain and recruit staff, leading to the third drop in employment in four months.

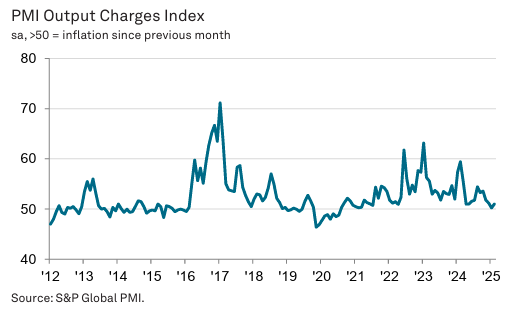

Muted Inflationary Pressures Keep Cost Growth Under Control

Input costs remained relatively mild compared to 2024 levels, despite some upward pressure from higher material prices due to the strength of the US dollar. While purchase price inflation accelerated slightly, staff costs declined, easing overall cost burdens. Companies opted for only modest price increases, with selling charges rising at a subdued pace.

Business Confidence Weakens Amid Uncertainty

Despite improving demand, business sentiment weakened, with expectations for future activity falling to their lowest since November 2024. Only 5 per cent of firms expressed optimism about output growth over the next 12 months, reflecting concerns over economic and geopolitical uncertainties.

Attribution: Amwal Al Ghad English

Subediting: M. S. Salama