During Tuesday closing session, the Egyptian Exchange (EGX) has pared its midday gains to eventually reach EGP 5.05 billion as the capital market has amounted to EGP 382.075 billion.

The main index, EGX30 soared by 1.49% to end at 5541.46 p. EGX20 climbed by 1.32% to finish at 6510.57 p.

Egypt’s benchmark share index rose 1.7% during Tuesday’s early session to its highest since June 2011 after a U.S. official said Washington was close to a deal with Egypt for $1 billion in debt relief.

U.S. diplomats and negotiators for Egypt’s new Islamist President Mohamed Mursi, who took office in June after the country’s first free presidential election, were working to finalize an agreement, the official said.

Egypt’s Prime Minister Hesham Kandil has opened the Egyptian Exchange’s trading session Tuesday morning. Kandil’s visit aims to convey a message to all investors that the Egyptian government’s top priority is achieving economic growth. The prime minister also wants to explain that the government is seeking to improve and upgrade the capital market so that it would help to push the economic growth wheel forward.

Kandil has also emphasized on the key role played by the Egyptian Exchange’s plans for the firms to stimulate economic growth.

Osama Saleh – Minister of Investment, Dr. Ashraf Al-Sharkawy – the Chairman of the Egyptian Financial Supervisory Authority (EFSA), and Dr. Mohamed Omran – the EGX chairman have also attended EGX’s opening session.

“The EGX is actually a vivid stream of financing and pushing firms towards growth and expansions. It annually contributes with billions of Egyptian pounds towards supporting the development plans.” Kandil noted

Meanwhile, the mid- and small-cap index, the EGX70 rose by 0.68% to conclude at 505.15 pts. Price index EGX100 surged by 1.16% to close at 855.19 p.

Traded volume reached 295.090 million securities worth EGP 884.173 million, exchanged 42.749 thousand transactions.

This was after trading in 185 listed securities; 41 declined 136 advanced while 8 keeping their previous levels.

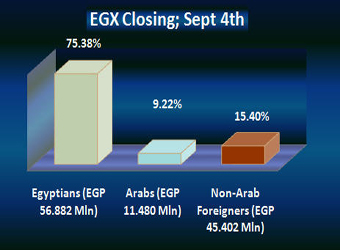

EGX30’s rise was backed by the fact that Egyptian investors were net buyers seizing 75.38% of the total markets, with a net equity of EGP 56.882 million excluding the deals.

On the other hand, Arabs and non-Arab Foreigners were net sellers seizing 9.22% and 15.4% respectively, of the total markets, with a net equity of EGP 11.480 million and EGP 45.402 million excluding the deals.

“More foreign investors will be looking at Egyptian companies for strategic investments in the coming months as it continues on the march to stability and fears subside of a sharp devaluation,” said Emad Mostaque, MENA strategist at Religare Capital Markets, in a client note. Traders said the market was dominated by local retail investors on Tuesday, suggesting gains were driven more by broad sentiment than specific news events such as the U.S. debt relief talks.

“Local retail is pushing this market higher and higher,” said Teymour el-Derini at brokerage Naeem. “Fundamental investors are only 10 percent of the market today… I don’t expect a correction any time soon.”