During Wednesday closing session, the Egyptian Exchange (EGX) has pared its midday gains to eventually reach EGP 657 million as the capital market has amounted to EGP 412.212 billion.

EGX indices closed in green.

The main index, EGX30 surged by 0.22% to close at 5969.39 p. EGX20 went up by 0.14% to end at 7024.87 p.

Meanwhile, the mid- and small-cap index, the EGX70 hiked by 0.96% to conclude at 574.02 pts. Price index EGX100 inched higher by 0.57% to finish at 941.14 p.

Traded volume reached 208.675 million securities worth EGP 777.680 million, exchanged through 44.464 thousand transactions.

This was after trading in 187 listed securities; 92 declined 85 advanced while 10 keeping their previous levels.

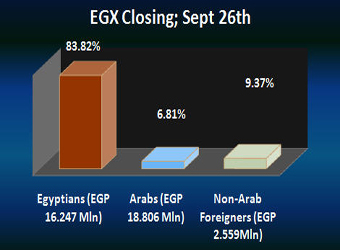

Egyptians and non-Arab Foreigners were net buyers seizing 83.82% and 9.37% respectively, of the total markets, with a net equity of EGP 16.247 million and EGP 2.559 million excluding the deals.

On the other hand, Arabs were net sellers seizing 6.81% of the total markets, with a net equity of EGP 18.806 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance.

Citadel Capital:

Citadel Capital (CCAP.CA) jumped by 2.61% to end at EGP 4.72.

ASEC Engineering, a portfolio company of ASEC Holding, has won Wednesday a second 10-year contract for the technical management of Misr Qena Cement, one of Egypt’s leading producers of cement.

Citadel Capital (CCAP.CA), private equity firm in the Middle East and Africa with $9.5bn in investments under control, announced that a key subsidiary of platform company ASEC Holding has signed a technical management agreement with Misr Qena Cement (MCQE.CA)for a second 10-year period.

“We are very pleased to have won renewal of this contract, as we feel that this is a clear endorsement of 10 years’ hard work by ASEC Engineering in Qena,” said ASEC Engineering Chief Executive Officer Mohamed Galal Yakout.

“We are looking forward to another decade of providing outstanding service to a trusted business partner,” he added.

The award was the result of a limited closed-envelope tender. ASEC Engineering provides technical management services for 12 kilns with a total output of c.16 million tons of clinker per year. Two of the production lines that ASEC Engineering manages are outside Egypt, namely in Syria and Jordan.

Telecom Egypt Co.:

Telecom Egypt (ETEL.CA)’s stock has overcome the announcement of TE Chairman’s resignation as it rose by 0.97% to conclude at EGP 14.53.

Telecom Egypt – TE had sent Tuesday a release to the Egyptian Exchange (EGX) announcing that the TE Chairman Akil Beshir resigned from his post and retired as of 01/10/2012. Beshir has served in TE for 12 years.

TE noted that the firm will be announcing a new Chairman of the board before the end of September.

“Throughout my term as the TE chairman, the company has witnessed significant changes in the local telecommunication market.” Eng. Akil Bashir said.

Beshir had been appointed Chairman and CEO of the Telecom Egypt in June 2000. He passed on his executive duties as CEO in August 2009, becoming non-Executive Chairman.

An official source at Ministry of Communications and Information Technology said that the resignation of Telecom Egypt’s (TE) Chairman Akil Beshir was for personal reasons. It added that a new board member will be appointed by Prime Minister Hisham Qandil, after which a board meeting will be held to elect a new Chairman.

For his part, Beshir indicated that the decision to retire was based on personal reasons, rebutting the rumors that the resignation was due to facing interrogations from the Administrative Control Authority (ACA).

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) inched higher by 0.52% to close at EGP 3.86.

Talaat Moustafa Group:

Talaat Moustafa Group (TMGH.CA) surged by 0.35% to close at EGP 5.70.

The Talaat Moustafa Group (TMG) is conducting negotiations with a number of banks to receive a long-term loan worth EGP 1.2 billion to finance the establishment of a mall in Madinaty City, New Cairo.

Sources said TMG submitted a request to the Arab African International Bank (AAIB) asking for the finance and the bank plans to ask other banks such as Banque Misr to contribute to arranging and managing the loan which prepares a feasible study on the project.

AAIB and the Commercial International Bank (CIB) offered in October 2012 finance worth EGP 855 million for TMG used to finance the Company’s expansions of Four Seasons Hotel in Sharm El-Sheikh.

TMG succeeded in passing the turmoil that followed 2011’s revolution unscathed, as it did not default on its loans, sources said, explaining why banks did not retreat in lending the Group.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) dived by 2.03% to end at EGP 12.06.

Orascom Construction Industries:

Orascom Construction Industries (OCIC.CA) went down by 0.27% to finish at EGP 292.34.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) kept Tuesday’s levels at EGP 0.56.