The Egyptian Exchange (EGX) has pared its early gains during Wednesday’s closing session to eventually reach EGP 2.6 billion. The capital market has reached to EGP 393.122 billion.

The EGX indices closed in green.

The main index, EGX30 surged by 1.08% to end at 5866.91 p. EGX20 inched up by 0.89% to close at 6763.97 p.

Meanwhile, the mid- and small-cap index, the EGX70 rose by 0.23% to conclude at 502.4 pts. Price index EGX100 went up by 0.42% to finish at 844.21 p.

During Wednesday’s closing, the trading volume has reached 151.985 million securities worth EGP 640.358 million, exchanged 32.220 thousand transactions.

This was after trading in 183 listed securities; 59 declined, 94 advanced; while 30 keeping their previous levels.

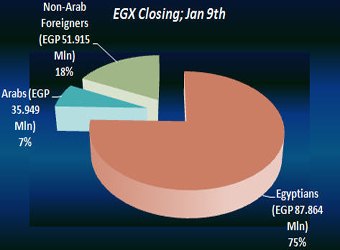

EGX’s gains were backed by Arabs and non-Arab foreigners’ buying transactions as they were net buyers seizing 6.88% and 17.66% respectively, of the total markets, with a net equity of EGP 35.949 million and EGP 51.915 million excluding the deals.

On the other hand, Egyptians were net sellers seizing 75.45% of the total markets, with a net equity of EGP 87.864 million excluding the deals.

IMF’s $ 4.8 Bln Loan:

Yasser Ali, spokesman for President Mohamed Morsi said that Egypt expects a visit from an International Monetary Fund (IMF) technical committee in two to three weeks.

“Negotiations with the IMF team will resume from where they stopped,” Ali said.

Egypt concluded an initial agreement with the IMF on a $4.8 billion loan in November but last month postponed conclusion of the deal because of political unrest set off by Morsi’s attempt to fast-track a new constitution. IMF Middle East and Central Asia Director Masood Ahmed met Morsi in Cairo last Monday.

Egypt’s government must strongly endorse a $4.8 billion IMF loan agreement to its people as a step towards stabilizing an economy pummeled by a turbulent transition from autocratic rule, the head of the world lender said on Tuesday.

Qatar Offers Egypt $2.5 Bln To Prop Up Pound

Qatar threw Egypt an economic lifeline on Tuesday, announcing it had lent the country another $2 billion and given it an extra $500 million outright to help control a currency crisis.

Political strife has set off a rush to convert Egyptian pounds to dollars over the past several weeks, sending the currency to a record low against the U.S. dollar and draining foreign reserves to a critical level.

The aid is a political and economic bonus for both President Mohamed Morsi and the Muslim Brotherhood, the group that propelled him to power in a June election.

It eases the pressure on Morsi to negotiate an IMF agreement that will require him to implement unpopular austerity measures. That will be a relief for the Brotherhood as it gears up for forthcoming parliamentary polls.

“There was an initial package of $2.5 billion, of which $0.5 billion was a grant and $2 billion a deposit,” Qatari Prime Minister Sheikh Hamad bin Jassim al-Thani told reporters, referring to the aid it has provided since Egypt’s uprising two years ago.

“We discussed transferring one of the deposits into an additional grant so that the grants became $1 billion and the deposits doubled to around $4 billion,” he said of the new aid after meeting Morsi.

Hamad added that the new Qatari grants and deposits with Egypt’s central bank had all arrived. “Some of the final details with the deposits are being worked on with the technical people, but the amount is there,” he said.