During Wednesday opening session, the Egyptian Exchange (EGX) has posted early gains of EGP 396 million as the capital market has amounted to EGP 391.575 billion, according to data compiled by Amwal Al Ghad at 10:55 a.m. Cairo time (08:55 GMT).

EGX indices opened mixed.

The main index, EGX30 rose by 0.16% to hit 5620.61 p. EGX20 inched lower by 0.02% to reach 6562.9 p.

Meanwhile, the mid- and small-cap index, the EGX70 fell by 0.12% to hit 524.56 pts. Price index EGX100 maintained with no change at 873.55 p.

Traded volume reached 4.899 million securities worth EGP 14.135 million, exchanged through 819 thousand transactions.

This was after trading in 77 listed securities; 46 declined 21 advanced while 10 keeping their previous levels.

EGX’s early gains were backed by non-Arab Foreigners’ buying deals.

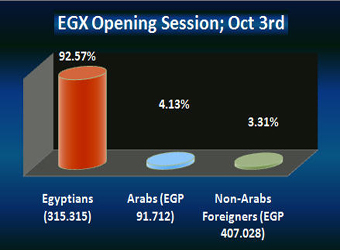

Egyptians and Arabs were net sellers seizing 92.57% and 4.13% respectively, of the total markets, with a net equity of EGP 315.315 thousand and EGP 91.712 thousand excluding the deals.

On the other hand, non-Arab Foreigners were net buyers seizing 3.31% of the total markets, with a net equity of EGP 407.028 thousand excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance during opening trading.

Citadel Capital:

Citadel Capital (CCAP.CA) dropped 1.72% to hit EGP 4.00.

This was after Golden Sachs had downgraded, in a recent study, on Tuesday Citadel Capital’s stock from ‘Neutral’ to ‘Sell’. Golden Sachs raised the company’s fair value from EGP 3.5 to EGP 4.17, 9% lower than the stock’s current price EGP4.6.

Golden Sachs has attributed the downgrading to ‘Sell’ to the stock’s recent strong rally.

Citadel Capital’s Managing Director announced late Monday that it intends to inject $2.5 billion in a projected oil refinery in east Africa’s third-largest economy Uganda

Uganda has said it intends to build a refinery once it starts producing crude oil, and it recently raised its estimated oil reserves to 3.5 billion barrels from 2.5 billion barrels.

Citadel secured $3.7 billion in financing for an Egyptian petroleum refinery project in June, and the firm’s managing director Karim Sadek said the company is now looking at refining potential deals in sub-Saharan Africa, including Uganda.

“Yes, we would be interested,” Sadek told Reuters in Nairobi, where he addressed a business club. “We know very well what’s happening on the Ugandan oil side and we’ve had discussions before.”

He said Citadel never invests in projects without a local partner, and he would not be drawn on the size of the investment the private equity group might make since the refinery plans are still in their infancy.

Uganda has outlined plans to build a refinery in Hoima, about 220 km west of its capital Kampala, and in July the government said it was aiming to take up to a 40 per cent stake in the plant with a private investor acquiring the remaining 60 per cent.

Uganda says it wants a facility with a maximum output of 120,000 barrels per day before production can commence, and that it intends to develop the project in phases, starting with a refining capacity of 20,000 barrels.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) climbed by 1.96% to hi EGP 0.52.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) went up by 1.13% to reach EGP 3.57.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) rebounded by 0.72% to hit EGP 11.18.

Orascom Construction Industries:

Orascom Construction Industries (OCIC.CA) inched higher by 0.70% to reach EGP 280.00.

Orascom Construction Industries announced Sunday that the Group will be finalizing the actual demerger process between its construction activities and its fertilizer arm within the coming November.

Omar Derwaza, Head of Investor Relations at OCI, said the Group has finalized all the necessary procedures for the demerger. OCI had completed outlining the demerger mechanisms alongside the situation of its two activities (Construction and Fertilizer) after the final demerger, Derwaza added.

Derwaza has also stated that OCI plans to finalize its demerger process with the coming November proceeded by the launch of the two firms; the Demerging Company (OCI Fertilizers) and the Demerged Company (Orascom Engineering and Construction).

The Group will inform the Egyptian Financial Supervisory Authority (EFSA) of any further updates about the demerger process, he noted.