Egypt’s stock market attained gains totalling 3 billion pounds in a week which witnessed chief army’s initiative to build one million homes for the poor in the country. The country’s main stock index – EGX30 surged by 2.4% in a week.

The housing project initiative marks the first campaign-style move by Field Marshal Abdel-Fattah al-Sisi, who is widely expected to run for president.

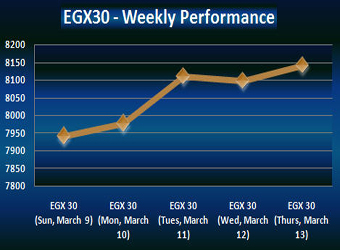

Going back to the indices’ activities during the week, the Egyptian Exchange’s benchmark index EGX 30 index pushed up by 2.4% in a week, registering an increase of 191.05 points, ending Thursday’s transactions at 8140.05 points compared to 7949 points at the end of a week earlier.

The main gauge index registered its highest point on Thursday closing at 8140.05 points, where its lowest point recorded on Sunday at 7939.84 points.

Meanwhile, the mid- and small-cap index, the EGX70 grew by 1% closing at 651.12 points during Thursday’s session, compared to 645 points at the end of a week earlier. The price index, EGX100 also increased by 1.1% concluding by 1115.57 points during Thursday’s session, against 1103 points at the end of a week earlier.

Turnovers & Traded Volumes:

Through the week, the trading volume hit around 1.5 billion securities, compared to 1.5 billion securities at the end of a week earlier. For the traded value, it reached EGP 5.9 billion against EGP 5.7 billion a week earlier.

Sectors Activity:

Telecommunications was the most active sector through last week, recording a volume of trades of 541.1 million securities worth EGP 1.011 billion.

Financial Services excluding Banks came second, attaining a volume of trades of 338 million securities worth EGP 1.062 billion.

Real Estate reported third, with a volume of trades of 201 million securities worth EGP 824 million.

Personal and Household Products sector was on the fourth position, getting a volume of trades of 154 million securities worth EGP 666 million.

Industrial Goods and Services and Automobiles came fifth, recording a volume of trades of 139 million securities worth EGP 278 million.

Travel & Leisure sector reported sixth, having a volume of trades of 132 million securities worth EGP 309 million.

Construction and Materials was on the seventh position, with a volume of trades of 76 million securities worth EGP 259 million.

Food and Beverage reported eighth, attaining a volume of trades of 35 million securities worth EGP 191 million.

Healthcare and Pharmaceuticals sector took the ninth position, with a volume of trades of 12.1 million securities worth EGP 37 million.

Basic Resources reported tenth, recording a volume of trades of 11.5 million securities worth EGP 166 million.

Banks ranked eleventh, attaining a volume of trades of 9.2 million securities worth EGP 244 million.

At the bottom of the list, Chemicals reported twelfth getting a volume of trades of 3 million securities worth EGP 36 million.

Investors’ Activity:

Local investors led the market activity all through the week with 88.16%, followed by Foreign and Arab investors with 5.35% and 6.48%, respectively, after excluding the deals.

Foreign investors were the most active sellers during the week earning the value of EGP 36.93 million, after excluding the deals.

Arab investors were to buy by value of EGP 12.05 million, after excluding the deals.

Moreover, institutions seized 36.07% of total trading through the week; while individuals attained 63.93% . Institutions were the most active sellers during the week earning the value of EGP 103.51 million, after excluding the deals.

Market Remarks

– Egypt Seen Releasing ETFs before End of March

The Exchange Traded Funds (ETFs) in Egypt could be open for business before the end of the current month, stock exchange vice chairman Khaled El-Nashar said last Monday.

Through the ETFs, Egypt is looking forward to increasing liquidity and attracting new investors onto the local market.

Khaled El-Nashar – Vice Chairman of the Egyptian Exchange (EGX) – said in an interview with Amwal Al Ghad the bourse’s Advisory Committee has recently discussed with the market regulator, the Egyptian Financial Supervisory Authority (EFSA) the recent developments in the ETFs file including the new mechanisms to enable investors to invest in the ETFs.

The ETFs file is due to be submitted for endorsement within the EFSA’s upcoming board meeting ahead of being released in the market, he noted.

Exchange traded funds serve as open investment funds which follow the movement of specific indicators, listing and trading their supplementary documents on the stock market as shares and bonds.

– EFG-Hermes Has ‘Robust’ Egypt IPO Pipeline amid Market Rally

EFG-Hermes Holding SAE (HRHO.CA), the biggest publicly traded Arab investment bank, has a “robust” pipeline for initial public offerings in Egypt as the stock market rallies, said co-Chief Executive Officer Karim Awad on Monday on the sidelines of EFG-Hermes One on One Conference in Dubai.

The IPO would be the first in Egypt since the 2011 uprising that ended Hosni Mubarak’s three-decade autocratic rule. The revolt was followed by political turmoil that prompted the army to remove Mubarak’s successor, Islamist President Mohamed Morsi, from power in July. Egypt’s benchmark EGX 30 Index has rallied more than 60 percent since the military’s intervention, making it one of the world’s best performers in 2014.

“We have a number of IPOs that we are currently pitching and others that we have been mandated,” Awad said in an interview in Dubai yesterday. The IPO of Cairo-based Arabian Cement Co. is set to close in the second quarter, according to Ahmed El Guindy, head of investment banking at EFG-Hermes, which was hired as joint lead manager for the offering in 2013.

– Egypt’s Market Watchdog Ratifies Regulations of ETFs, Margin Trading

Last Wednesday, Egypt’s market watchdog ratified the regulations governing the ETFs alongside the margin trading.

The board of market watchdog Egyptian Financial Supervisory Authority (EFSA) discussed on Wednesday a number of key topics, mainly regulations of ETFs, market makers, in addition to issuing decisions required for margin trading.

EFSA Chairman Sherif Samy said the regulator approved the rules regulating ETFs and market makers, and stipulated EFSA’s approval on the methodology adopted in the preparation of the exchange-traded fund, except for ETFs issued by the Egyptian Exchange (EGX).

The market regulator also stipulated that there must not be a relation between the issuing party and the investment manager or the market maker.

The top official also indicated that, in light of the recent amendments to the Capital Market Bylaw that reduced the minimum limit for approving a securities company to carry out margin trading to EGP 4 million as net equity from EGP 15 million as minimum limit for capital, EFSA board set the percentage of the client debts at which the company can make a claim for reduction.