Global commodity prices surged to a 21-month high by the end of June 2024, driven by escalating supply chain challenges.

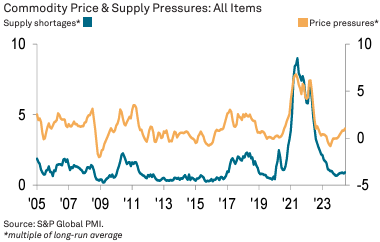

The index measuring global price pressures hit 1.0, marking its highest level since September 2022, indicating a steady rise in commodity prices aligned with long-term averages.

Among the 26 commodities monitored, 23 experienced price hikes, notably aluminium and electrical items, with aluminium facing increased pressure following recent sanctions on Russian metal exports.

Concurrently, the Global Supply Shortages Index registered at 0.9, nearly reaching typical long-term levels, underscoring widespread raw material deficits. Stainless steel and electrical components reported the most severe shortages, with paper seeing its highest deficit in 17 months.

This environment of heightened price and supply constraints reflects ongoing global economic uncertainties, prompting concerns among major central banks considering rate adjustments.

Maryam Baluch, Economist at S&P Global Market Intelligence, highlighted the implications of these findings, noting that while current price pressures warrant attention, they remain below peak levels observed in 2021. She emphasized the potential exacerbation of supply disruptions due to sanctions on Russian exports and ongoing Red Sea disruptions, posing risks of prolonged raw material scarcities into the following year.

These dynamics underscore the challenges facing global manufacturing sectors reliant on stable commodity markets amidst geopolitical tensions and logistical disruptions.

Looking forward, analysts anticipate continued volatility in global commodity markets as economic recovery efforts intersect with geopolitical developments, influencing supply chains and pricing dynamics worldwide. As stakeholders navigate these complexities, monitoring price and supply indicators will be crucial in assessing market resilience and economic stability.

Attribution: S&P Global PMI Commodity Price & Supply Indicators.