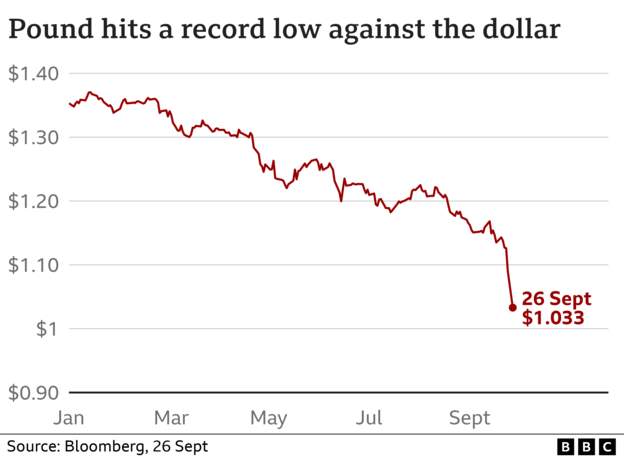

The pound on Monday reached a record low against the dollar as markets react to the UK’s biggest tax cuts in 50 years.

In early Asia trade, the pound dropped to $1.03 before regaining some ground to stand at about $1.07 on Monday morning.

On Monday morning in Asia, while most of the UK was sleeping, the pound fallen apart more than 4 percent versus the US dollar.

That declined sterling to a record low against the greenback.

It’s worth noting that the slip came early in the Asia session, when pound-dollar trading can be volatile because of low volumes.

That said, even though regaining some ground, the pound is trading still at around $1.05.

The pound’s drop came after UK Chancellor Kwasi Kwarteng on Sunday promised more tax cuts on top of a £45 billion ($2.3 billion) package he announced on Friday, amid expectations borrowing will rise.

Sterling, along with other major currencies, has also been under pressure as a result of the strength of the dollar.

The pound dived in response to the Conservative government’s huge tax cutting mini-budget, lowering sharply as Chancellor Kwasi Kwarteng spoke on Friday.

It then dipped again in early trading on Monday reaching $1.04.

Jane Foley, a currency strategist at Rabobank, said the sell-off showed investors were worried that some of the announced tax cuts would not be fully-funded.

The pound was already declining against the dollar in the weeks leading up to the mini-Budget, partly down to the dollar’s wider strength.

Nevertheless, our economics correspondent Dharshini David stated that on Friday night sterling has seen the second biggest drop against the dollar compared with the week before of any major currency. Moreover, the worst affected was the Swedish krona.

It was trading at $1.135 earlier in September. It is considering as the first time it had fallen below the $1.14 mark in nearly four decades.

As Chancellor Kwasi Kwarteng informed the UK’s mini-budget on Friday the pound lowered to a 37-year low.

Sterling decreased more than 3 percent against the dollar, dropping below $1.09, as investors questioned the huge tax cuts in Kwarteng’s plan.

Markets ended for the weekend and when they re-opened, first in Asia, sterling dropped further – close to $1.03.

The pound has now returned some ground to stand at about $1.07 by the time the markets opened in the UK on Monday morning.

The value of pound affects everyone, from holidaymakers and shoppers, to business-owners and investors.

If the pound’s value is less, the cost of importing goods from overseas goes up.

By way of example, as oil is priced in dollars a weak pound can make filling up your car with petrol more expensive. In dollars, Gas is also priced.

Technology goods, like iPhones, that are made overseas, may get more expensive in UK shops. Even things that are made in the UK but from parts that are bought abroad can get much more expensive.

Very often, the pound is compared with the US dollar, given the huge size of the American economy.

It is also frequently compared to the euro, because of the UK’s close trading relationship with the EU, but can be matched to any currency around the world.

Chancellor Kwasi Kwarteng stated the biggest package of tax cuts in 50 years on Friday.

He pointed that the high tax rates “damage Britain’s competitiveness”, decreasing the incentive to work and for business to invest, and added that cutting taxes was the answer.

Although, a fall in sterling following his announcement, Kwarteng said on Sunday more tax cuts were to come.

The government affirms its “ambitious” growth plan will boost the economy.

Why Asian investors sold the pound ?

The UK Chancellor’s historic tax cuts are having an impact far and extensive.

In Asia, investors have been selling off their pounds in favour of the stronger dollar and other currencies.

They are losing confidence about growth in the UK and are concerned the procedures will stretch the government’s finances to their limit.

And with UK government planning to cut taxes, there are fears inflation won’t be brought under control, which could mean higher interest rates going forward.

This would make the price of borrowing more expensive, and hurt Asian currencies and equities.

Japan’s benchmark Nikkei index ended down almost 3 percent after dropping to its lowest level since mid-July and other Asian markets also fallen apart on Monday.

Notwithstanding, the pound is just one of many uncertainties facing investors and traders in Asia and what comes next is rattling them even more – slow growth or recession, even higher interest rates to tame inflation, potential intervention.

The pound was already under compression after the dollar was heightened by the US central bank continuing to raise interest rates.

Other currencies are also under pressure in the region – the euro raised a fresh 20-year-low against the dollar in morning Asia trade.

Situation is alarming – former Bank of England deputy governor

The former deputy governor of the Bank of England Sir John Gieve said the fall in sterling is alarming.

He was asked on Radio 4’s Today programme whether the economic downturn will lead the bank to convene an emergency meeting. “yes, that is what they’ll have to do if they want to change base rates.” he answered.

He highlighted that the bank will wish to avoid holding an emergency meeting “if at all possible” at a time earlier than their next planned meeting in November, as holding a series of meetings at predictable times was “part of the regime” put in place when the bank was made independent.