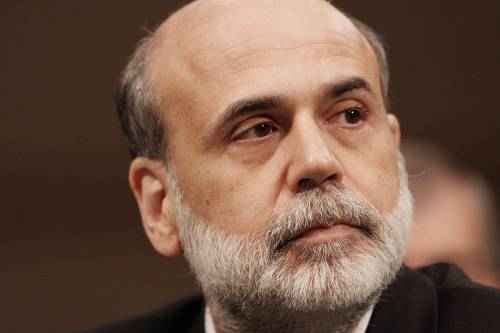

Bloomberg – The Standard & Poor’s 500 Index is approaching the cheapest levelever compared with bonds as Federal Reserve Chairman Ben S. Bernanke’s zero-percent interest rates drive investors and companies from cash.

Profits that doubled since 2009 pushed the index’s so- called earnings yield to 7.1 percent, close to the highest on record when compared with the 10-year Treasury rate, according to data compiled by Bloomberg since 1962. American companies have boosted capital spending 35 percent over six quarters, the most since 2006.

“Conditions are almost ideal for equity investors relative to all other investments,” Keith Wirtz, who oversees $14.6 billion as chief investment officer for Fifth Third Asset Management in Cincinnati, said in a Feb. 14 telephone interview. “The Fed’s keeping rates low for the foreseeable future to try to stimulate the environment for employee hiring and business activity. What does that mean for capital markets? Savers are not being rewarded.”

The U.S. government and the Fed lent, spent or guaranteed as much as $12.8 trillion to end the worst recession since the 1930s. That and Bernanke’s three-year effort to drive down interest rates are paying off with rising consumer confidence and expanding factory output. The S&P 500 (SPX) is off to its best annual start since 1997 as riskier assets lure money from savings accounts offering some of the lowest yields on record.