The Banker: Egypt remains key African investment hub despite economic hassles

Egypt continues to stand out as one of Africa’s key investment hotspots, despite the country’s mounting economic niggles, said the UK financial institute The Banker in a recent report.

“While successive currency depreciations and the increasing takeover of the economy by the army have crimped private investment in recent years, the north African country was the stand-out venue for deals on the continent in 2022, thanks in no small part to the role of UAE state and state-affiliated investors.” The Banker explained.

Healthy levels of mergers and acquisitions (M&A) activity in Egypt stands in contrast to much of the rest of the continent. In line with international trends, Africa witnessed a downturn in M&A activity in 2022, following the explosion of deals in 2021. Yet, M&A activity still remains healthy within the continent’s finance and fintech sectors. While much of this activity centred on Egypt, significant deals were also reported in the continent’s other major economies in the continent, notably Kenya and Nigeria.

“If 2021 was the year when the world dared to dream of a return to normality, as the spectre of COVID-19 receded, 2022 was a year of frustrated expectations. Russia’s invasion of Ukraine in February cast new uncertainties across the global economic landscape, with funding for deals severely restricted as interest rates rose globally throughout the year.”

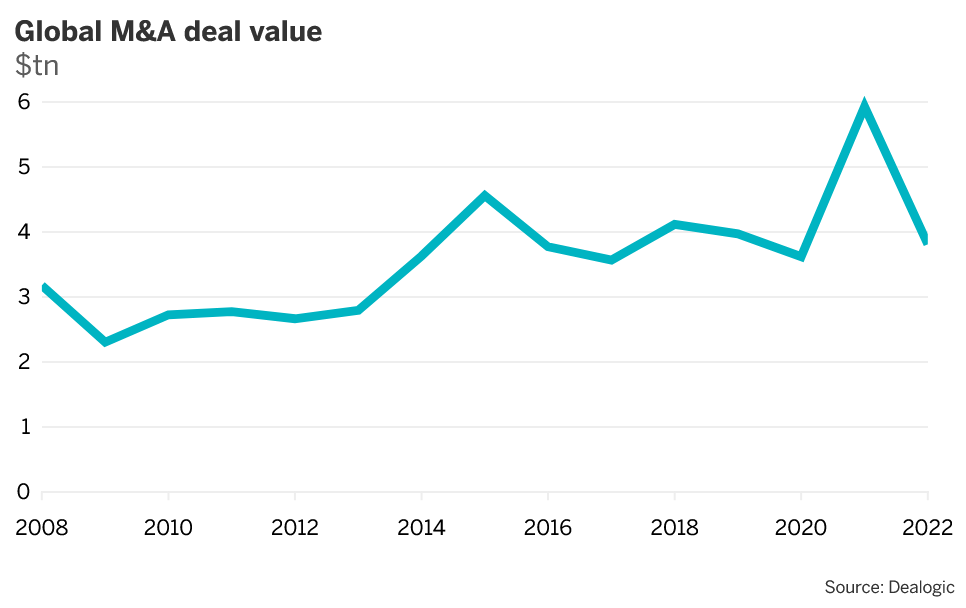

After jumping by around two-thirds in 2021, global deal values drop back 36 percent to $3.8 trillion in 2022, data from Dealogic showed. The slowdown was particularly sharp in the second half of the year, with values decreasing by a third compared with the first six months of the year.

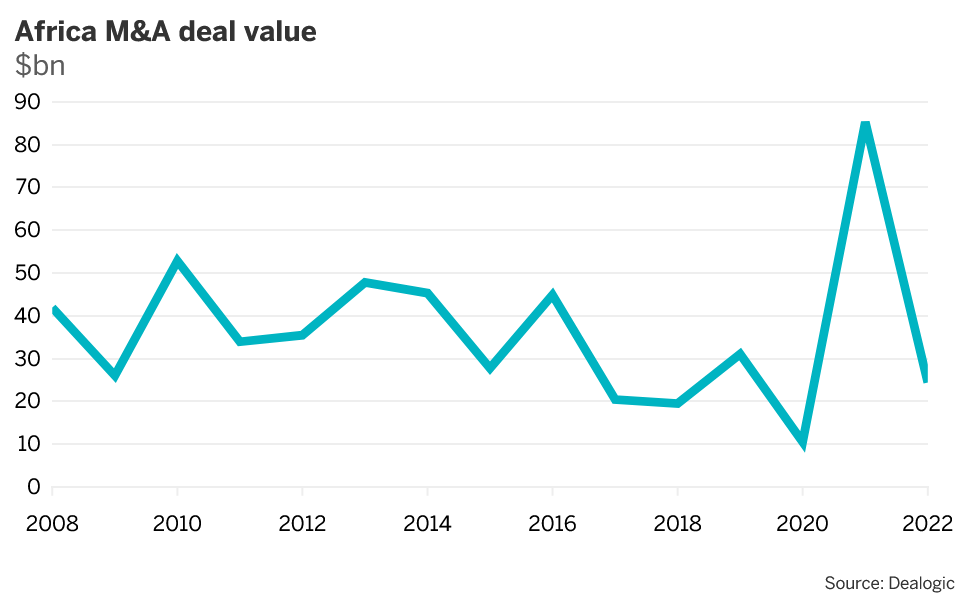

The trend was even more pronounced in Africa, following a record year in 2021 that witnessed values surge by more than 700 percent. While deal volumes in 2022 recorded a year-on-year rise of 17 percent, values dropped 71 percent to $24.4 billion, broadly in line with the five-year average for the continent prior to the pandemic.

“In 2021, interest rates were still very low, while private equity and venture capital investor capitals had significant funds to deploy. With deals in the developed world becoming increasingly expensive, African companies became increasingly attractive, given the continent’s demographics and medium-term growth potential,” Michael Louw, head of M&A at KPMG South Africa, told The Banker.

“The drop off in values in 2022 came as management policy tightened in a more challenging economic environment, both in Africa and elsewhere, with other investors choosing to take a wait-and-see approach until interest rates flatten out again.” Louw added.

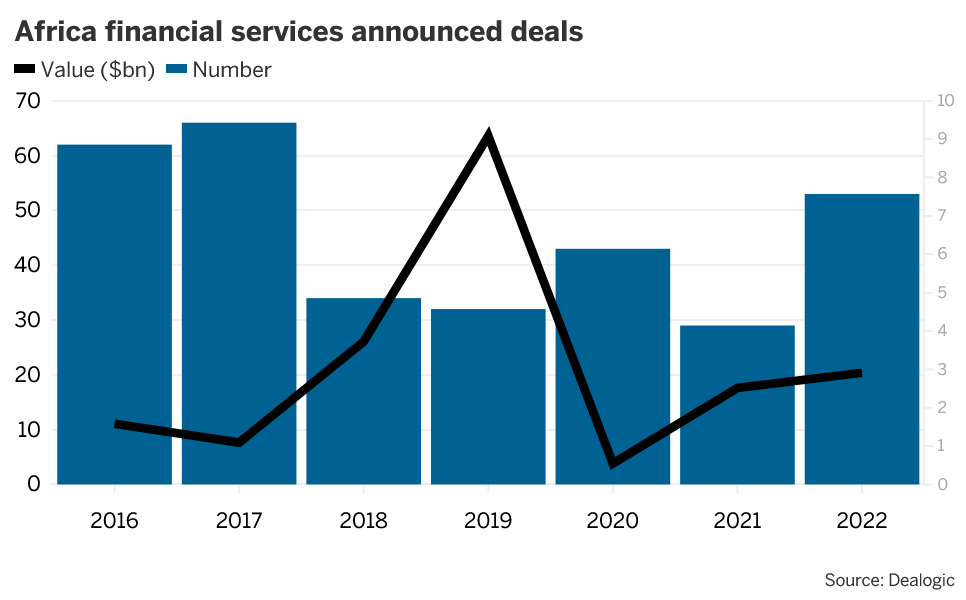

While the extractive industries of mining and oil and gas together make up a third of total deal values, the finance and technology — including fintech — sectors witnessed greater volumes, accounting for a third of all deals announced on the continent throughout 2022.

Deals within Africa’s financial sector in particular proved especially buoyant, bucking the fall witnessed across other sectors. Deal values in the financial space surged by 16 percent to $2.9 billion for 2022, with volumes up, according to Dealogic.

“Perhaps unsurprisingly, the continent’s three largest economies — Egypt, Nigeria and South Africa — remain dominant in terms of overall deal-making, together accounting for seven of the continent’s 10 largest deals announced during the year.” The Banker report read.

The single largest deal across Africa’s financial services sector for the year was the acquisition of a 17 percent stake in the Commercial International Bank (CIB) — Egypt’s third-largest lender by assets — by Abu Dhabi-based sovereign wealth fund ADQ. The CIB shares were acquired from National Bank of Egypt (NBE), the country’s largest lender, for $910 million.

The CIB deal was the largest component of deals worth $1.85 billion revealed by ADQ in April last year, in a potent demonstration of the deepening political and economic relationship between Egypt and the UAE at the government level.

“With its large economy, huge population and geographic proximity, Egypt has always been an attractive investment destination for Gulf Co-operation Council (GCC) companies,” Tarek Fadlallah, CEO of Nomura Asset Management (Middle East), told The Banker.

“It is now GCC governments that are leading the new phase of investments into mutually beneficial industrial developments.” Fadlallah added.

Following the CIB deal, ADQ revealed plans later in October 2022 to invest up to $20 billion into a wide range of sectors over the coming decade, in partnership with the Sovereign Fund of Egypt (TSFE).

Such a commitment is set to be matched by Saudi Arabia; since its Public Investment Fund (PIF) launched last year the Saudi Egyptian Investment Company, with plans to investing in sectors including infrastructure, real estate development, healthcare, and financial services.

UAE Growing Interest

UAE interest in Egypt’s banking sector is way greater beyond the ADQ deal. First Abu Dhabi Bank (FAB), the Emirati largest lender by assets, announced an offer to buy a majority stake in Egyptian investment bank EFG Hermes in March 2022, only for the offer to be withdrawn the following month. The move followed FAB’s announcement of the takeover of troubled Lebanese lender Bank Audi’s banking network in Egypt in 2021, with the deal been completed in June 2022.

Fellow UAE lender Abu Dhabi Islamic Bank (ADIB), the country’s seventh-largest Islamic lender, in early January 2023 raised its stake in its Egyptian operations to 52.6 percent, according to bourse filings. During 2022, ADIB announced its intention to offload its majority stake in Cairo National Securities.

“Aside from the conventional banking sector, the attractiveness of Egyptian fintech assets is only set to increase in the coming years, with regulations issued by the Central Bank of Egypt and the Financial Regulatory Authority in recent years creating an explosion of activity within the digital financial sphere.” The Banker said.

CBE Initiatives announced during 2022 included Egypt’s new fintech law, aimed at further boosting the use of technology in the country’s non-banking financial sector, and new plans by the Information Technology Industry Development Agency (ITIDA) to expand foreign investment in the local tech ecosystem.

Beyond the CIB stake acquisition, one of the other highlights of ADQ’s April deals splurge was the acquisition of a 12.6 percent stake in electronic payments provider Fawry for $69 million, the second-largest fintech deal in Africa in 2022, behind the $110 million joint investment in Nigeria’s Interswitch by LeapFrog Investments and Tana Africa Capital.

Local telco, Vodafone Egypt announced in April that it had boosted its shareholding in local fintechs Bee and Masary — both subsidiaries of Ebtikar Holding for Financial Investments — to 9.99 percent each, through a subscription in capital increases for the two entities.

However, such deals have been dwarfed by the $400 million worth of funding raised by Egyptian fintech MNT-Halan in February 2023, led by Chimera Abu Dhabi.

Under the deal, Chimera — part of Abu Dhabi’s Royal Group, controlled by the UAE’s national security adviser and billionaire businessman Sheikh Tahnoon bin Zayed Al-Nahyan — will take a 20 percent stake in the company for $200 million. Other funding partners were Development Partners International, Apis Growth Fund II, and Lorax Capital Partners.

Other international investors from beyond are also being attracted to Egypt’s fintech space. Payments-enabler Paymob secured $50 million worth of Series B funding in May 2022, with PayPal Ventures, Kora Capital, and Clay Point leading the round.

The same month witnessed Amazon agree to take over $10 million worth of EFG Hermes global depositary receipt shares with an option to convert them into a 4 percent stake in ValU — the bank’s rapidly growing buy-now, pay-later arm — adding ValU as a payment option for amazon.eg from July.