Barclays Plc economists forecast that several developing nations would see “some tangible benefits” of the International Monetary Fund’s (IMF) proposal to allocate $500 billion in reserve assets known as special drawing rights.

The IMF’s Managing Director Kristalina Georgieva said earlier this month that the fund is proceeding with work on the plan after the Group of 20 urged it to propose a fresh allocation of the fund’s reserve assets.

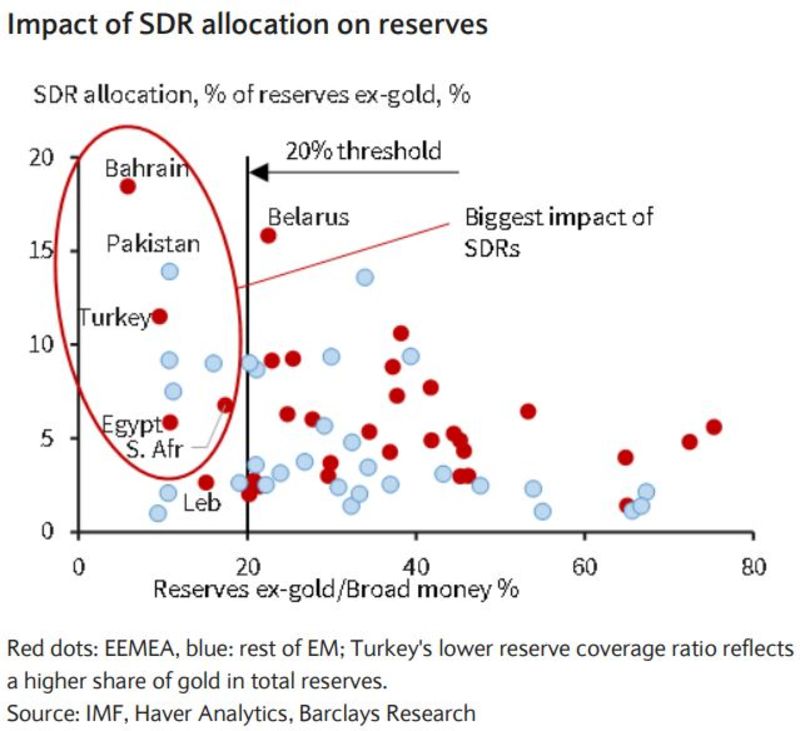

Emerging-market countries will probably stand at “no more than” $206 billion of the new special drawing rights (SDRs) allocations, said Barclays economists, including Ercan Erguzel, in a report to clients.

According to Barclays, Bahrain could exchange its SDR holdings with Saudi Arabia to increase reserves. The distribution may also benefit Turkey, “where the central bank aims to reverse the downtrend in reserves.” it added.

Barclays estimated that Zambia’s additional allocation could stand at around $1.1 billion, or some 6 percent of gross domestic product (GDP), “thus placing the country in a less fragile position as it embarks on its debt restructuring talks”

Countries including Egypt and South Africa also stand to gain from the increase in reserve, Barclays noted.

For South Africa, Barclays estimated that the country’s foreign-exchange holdings may be boosted by the equivalent of some $3.2 billion

The South African government “could in fact come to some arrangement” with the South African Reserve Bank (SARB) where the central bank “keeps the SDRs but Treasury liquidates an equivalent amount from its excess reserves at the SARB to fund its external borrowing commitments for the year.” Barclays said.

Momentum has been building for the injection of funds after U.S. Treasury Secretary Janet Yellen leaned toward supporting the action, reversing opposition last year under former U.S. President Donald Trump. Her predecessor, Steven Mnuchin, blocked the step in 2020, saying that because reserves are allocated to all 190 members of the IMF in proportion to their quota, some 70 percent would go to the G-20, with just 3 percent for the poorest developing nations.

“The COVID-19 pandemic has morphed into a global health crisis, necessitating closer global policy coordination to rein in infection spread,” the Barclays economists added in the note.

“This has brought the IMF’s role as global ‘firefighter’ back to the centre stage.”