Driven by the new clashes erupted between the masses and police marking a further political crisis in the country, the Egyptian Exchange has opened this week posting severe losses of EGP 7.8 billion. The capital market has amounted to EGP 373.868 billion during Sunday’s opening session, according to data compiled by Amwal Al Ghad at 11:00 a.m. Cairo time (09:00 GMT).

The EGX indices opened in dark red.

The main index, EGX30 pushed down by 1.55% to 5601.23 p. EGX20 fell by 1.93% to 6383.88 p.

Meanwhile, the mid- and small-cap index, the EGX70 sank by 2.31% to 458.12 p. Price index EGX100 inched down by 2.26% to 782.54 p.

This was after trading in 109 listed securities; 86 declined, 4 advanced; while 19 keeping their previous levels.

During the opening session, the trading volume has reached 19.794 million securities worth EGP 34.738 million, exchanged 1.957 thousand transactions.

On Saturday, a court sentenced to death 21 of the 73 defendants accused in the Port Said soccer stadium disaster occurred on February 1st, 2012.

In Port Said, growing unrests stirred up over the court’s verdict sentencing to death 21 people found guilty over a 2012 soccer stadium disaster.

30 more were killed in fierce confrontations that broke out in Port Said, where police forces locked horns with families and supporters of 21 defendants sentenced to death in connection to last year’s soccer stadium disaster.

Ghada Tolba, technical analyst at Luxor Securities Brokerage, said the court’s ruling on the Port Said football massacre case was supposed to result in positive impact on the market. However, the clashes erupted between the police officers and defendants’ families alongside the escalating violence in Port Said will likely lead to the EGX’s decline.

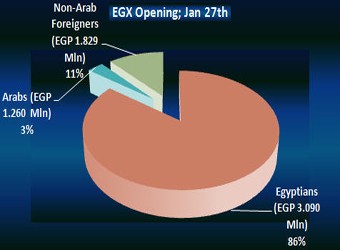

The EGX’s opening losses were driven by local sellers as they were net sellers seizing 85.49% of the total markets, with a net equity of EGP 3.090 million excluding the deals.

Meanwhile, Arabs and non-Arab foreigners were net buyers seizing 3.27% and 11.23% respectively, of the total markets, with a net equity of EGP 1.260 million and EGP 1.829 million excluding the deals.

Political Crisis Looms:

As a result of the recent violence, president Morsi opted not to travel to Ethiopia to attend an African economic summit.

On Saturday evening, Egypt’s National Defence Council, led by President Morsi, said it might consider declaring a state of emergency in areas of violence, calling for dialogue with opposition forces over ongoing clashes in several governorates.

Opposition forces, however, do not look poised to agree to the dialogue.

Several political parties and groups embarked on a demonstration Saturday afternoon marching from Tahrir Square’s Omar Makram Mosque to the nearby Shura Council (the lower house of parliament) protesting Friday’s killings and calling for the realization of the revolution’s demands.

Central Security Forces (CSF) used teargas to disperse hundreds of marchers near the Shura Council on Qasr El-Aini Street, off Tahrir Square. Many were arrested in the area afterwards.

Egypt’s main opposition grouping, the National Salvation Front (NSF), has urged President Morsi to respond positively to five demands announced by the group, or else face mass peaceful protests.

For its part, the Muslim Brotherhood, said in a statement that “thugs,” “misleading” media, and opposition parties were to blame for the nationwide violence, inferring in particular that the violence was pre-planned.

Meanwhile, Britain and Germany have called on all sides in the ongoing process of polarization in the country to reach peaceful solutions.